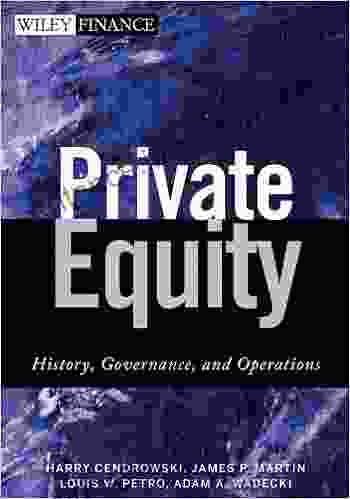

Private Equity: A Comprehensive Exploration of History, Governance, and Operations

Private equity, a multifaceted and dynamic investment vehicle, has emerged as a significant force in the financial landscape. Its ability to unlock value, foster innovation, and drive economic growth has captured the attention of investors worldwide. This comprehensive article delves into the captivating world of private equity, tracing its historical roots, exploring its governance structures, and unraveling its operational complexities. 4.2 out of 5 Whether you're an experienced investor seeking to expand your knowledge or an aspiring entrepreneur eager to understand the private equity landscape, this guidebook provides invaluable insights. Join us as we embark on a journey through the intricate world of private equity, empowering you to make informed decisions and unlock the potential of this transformative investment strategy. The origins of private equity can be traced back to the early 20th century, with the emergence of closed-end investment companies. These companies pooled investor capital to invest in various assets, including private businesses. However, it was during the post-World War II era that private equity truly began to take shape. In the 1950s and 1960s, a group of visionary investors, such as Henry Kravis and George Roberts, pioneered a new approach to private equity. They focused on acquiring controlling stakes in underperforming companies, restructuring them, and unlocking hidden value. This strategy proved to be highly successful, paving the way for the modern private equity industry. The private equity landscape continued to evolve in the following decades, with the emergence of specialized funds targeting specific industries and strategies. The 1980s and 1990s witnessed a surge in leveraged buyouts, as private equity firms utilized debt to acquire companies at a larger scale. Today, private equity is a global industry with a significant impact on the economy. Private equity firms manage trillions of dollars in assets, investing in a wide range of companies, from startups to mature businesses. The industry has played a pivotal role in driving innovation, creating jobs, and fostering economic growth. Effective governance is essential for the success and integrity of private equity funds. Private equity firms typically operate as limited partnerships, with investors contributing capital and committing to certain investment terms. The general partner (GP) manages the fund, makes investment decisions, and oversees the operations of the portfolio companies. The GP has a fiduciary duty to act in the best interests of investors. To ensure alignment of interests, GPs typically invest their own capital alongside investors. Private equity funds are subject to various regulatory requirements, including disclosure and reporting obligations. Investors typically have limited involvement in the fund's management, but they have the right to receive regular updates and participate in key decisions, such as fund termination. Private equity firms have a responsibility to maintain high ethical standards and comply with applicable laws and regulations. The industry has developed various self-regulatory initiatives, such as the Private Equity Growth Capital Council (PECGC) and the Institutional Limited Partners Association (ILPA),to promote best practices and ethical conduct. Private equity firms employ a range of strategies to generate returns for investors. These strategies can be broadly categorized into three main types: buyout, growth equity, and venture capital. Buyout funds typically acquire controlling stakes in mature companies with the aim of improving their operations, increasing their profitability, and ultimately selling them at a profit. Growth equity funds invest in high-growth companies with the potential to scale rapidly. Venture capital funds provide funding to early-stage startups with the potential for significant growth and innovation. The investment process in private equity typically involves rigorous due diligence, financial analysis, and negotiation. Private equity firms work closely with management teams to develop and implement value-creation strategies. They may provide operational support, strategic guidance, and access to capital to help portfolio companies achieve their full potential. Private equity funds typically have a finite investment period, ranging from 5 to 10 years. During this period, the GP actively manages the portfolio companies, working to increase their value and generate returns for investors. Upon the expiration of the investment period, the fund may be liquidated, and the proceeds distributed to investors. Private equity is a dynamic and complex investment vehicle that offers the potential for attractive returns. However, it is important for investors to understand the risks and complexities involved before committing capital. This comprehensive article has provided an overview of the history, governance, and operations of private equity, empowering you with the knowledge to make informed investment decisions. Whether you're an experienced investor seeking to expand your portfolio or an entrepreneur eager to tap into the power of private equity, this guidebook has provided valuable insights. The world of private equity is constantly evolving, presenting new opportunities and challenges. Stay informed about industry trends, conduct thorough research, and seek professional advice when necessary to navigate this multifaceted investment landscape successfully. As the private equity industry continues to grow and evolve, it will undoubtedly play an increasingly significant role in shaping the global economy. Its ability to drive innovation, create jobs, and foster economic growth makes it an essential component of the financial ecosystem.Language : English File size : 3552 KB Text-to-Speech : Enabled Screen Reader : Supported Word Wise : Enabled Print length : 480 pages Lending : Enabled Historical Evolution of Private Equity

Governance Structures in Private Equity

Private Equity Operations

Resources

4.2 out of 5

| Language | : | English |

| File size | : | 3552 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 480 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia James M Jay

James M Jay James N Webb

James N Webb James Bannon

James Bannon Jean Jacques Rousseau

Jean Jacques Rousseau Janell Burley Hofmann

Janell Burley Hofmann James L Brewster

James L Brewster James Ciment

James Ciment James W Evans

James W Evans Jamie L H Goodall

Jamie L H Goodall James Moore

James Moore James H Willbanks

James H Willbanks Jane Mount

Jane Mount Jathan Sadowski

Jathan Sadowski James Kakalios

James Kakalios Jean Boiffin

Jean Boiffin Jason Gray

Jason Gray James Walsh

James Walsh James King

James King Jean Jacques Antier

Jean Jacques Antier Janie Reinart

Janie Reinart

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Isaias BlairUnveiling the Intriguing Entanglements of Custom and Modernity in Papua New...

Isaias BlairUnveiling the Intriguing Entanglements of Custom and Modernity in Papua New... Arthur C. ClarkeFollow ·7.6k

Arthur C. ClarkeFollow ·7.6k Joseph HellerFollow ·2.3k

Joseph HellerFollow ·2.3k Miguel de CervantesFollow ·4.7k

Miguel de CervantesFollow ·4.7k Griffin MitchellFollow ·12.8k

Griffin MitchellFollow ·12.8k Jett PowellFollow ·16.8k

Jett PowellFollow ·16.8k Nathan ReedFollow ·18.7k

Nathan ReedFollow ·18.7k Logan CoxFollow ·18.8k

Logan CoxFollow ·18.8k Calvin FisherFollow ·5.2k

Calvin FisherFollow ·5.2k

Jacob Foster

Jacob FosterPrinciples and Persons: The Legacy of Derek Parfit

Derek Parfit's 1984 book,...

Leo Mitchell

Leo MitchellPartners For Life: Raise Support For Your Missionary Work...

Are you a missionary or ministry leader...

Blake Kennedy

Blake KennedyOn Desperate Ground: A Gripping Account of World War II's...

Hampton Sides' "On...

Duane Kelly

Duane KellyCriminal Minds Sociopaths Serial Killers And Other...

In the realm of criminology,...

Craig Blair

Craig BlairHome Repair: The Ultimate Guide to Fix, Maintain, and...

Welcome to the...

Elmer Powell

Elmer PowellThe Organic Grower Guide to Mycorrhizae Science for...

Unlock the Secrets of Soil...

4.2 out of 5

| Language | : | English |

| File size | : | 3552 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 480 pages |

| Lending | : | Enabled |